- Buy Now Pay Later (BNPL) platforms like Klarna are becoming one of the fastest-growing online payment methods.

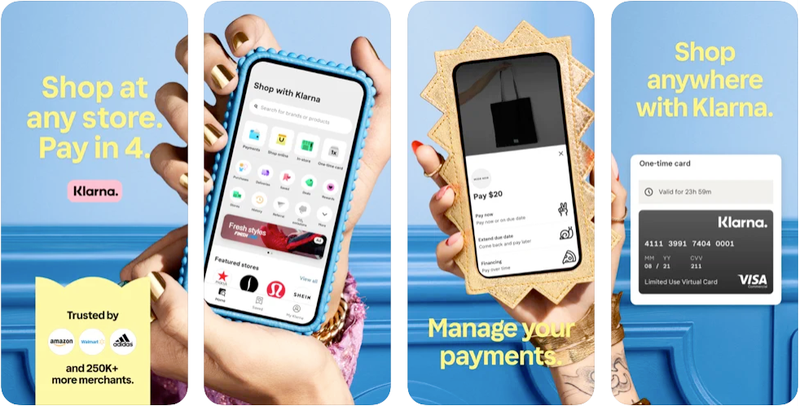

- You can use the Klarna app as a checkout option virtually anywhere even when a retailer doesn’t employ it as a checkout option.

- In order to use Klarna no fees are charged.

More millennials are turning away from credit cards, but still wanting choice in how they pay for their items. Klarna is one of several financial tech companies that are offering consumers the ability to purchase items without needing to pay everything upfront.

The Buy Now, Pay Later payment solution has been revolutionising the shopping experience and disrupting credit cards. So, how does Klarna stack up?

In this review, we will go through just how useful it is, and what impact it has on our finances.

Klarna

Maximum loan amount

N/A

Repayment

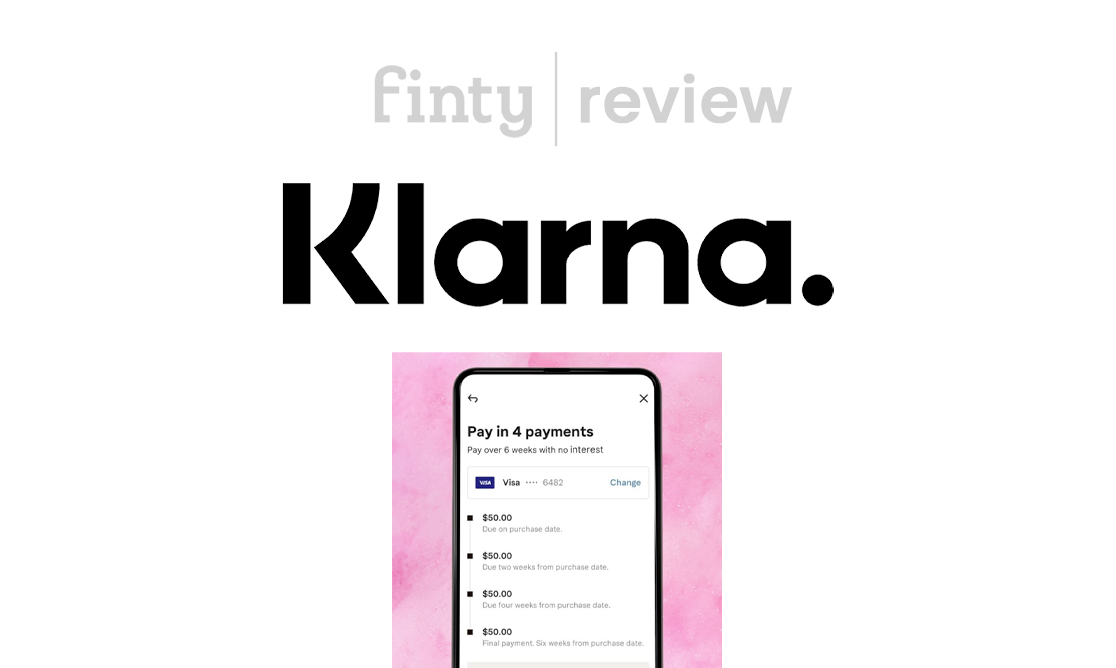

Four equal instalments paid fortnightly

Late fee

$3.00

Highlights

- Enjoy the flexibility to get what you want and pay over time.

- Pay in 4 with Klarna through their app, with integrated brands, or anywhere Visa is accepted.

- Klarna's instant approval process has zero impact on your credit score.

Inside this review

What is a BNPL digital wallet?

More and more consumers are shunning debit cards and cash for digital wallets. These are digital financial accounts that are used to make purchases and track your transactions. Buy Now Pay Later (BNPL) platforms like Klarna are becoming one of the fastest-growing online payment methods.

Using Klarna is as easy as using your contactless card. You can add their digital card to your phone's wallet from the Klarna app. This means being able to buy now, pay later wherever you are.

Who is Klarna for?

It's aimed more at the younger market who don't want the commitment of a credit card, but the benefits of being flexible with their money.

With so many people favouring their virtual card and exclusive deals, Klarna has even expanded to partner with huge popular clothing retailers such as ASOS and H&M.

Do they do a credit check?

Klarna does perform credit checks when first going to checkout with them. The result is then stored for 90 days in their system. If you then made another purchase after the 90 days or changed any personal information, they perform another check.

The key thing is that the check will come up on your credit report, but it does not directly affect yourcredit score. These checks allow for more responsible lending, so the consumer doesn't buy more than their bank account can handle.

Fees

They do charge late fees in the case of missing a payment, or not having adequate money in your account by the due date.

Late fees start at $3 for orders under $100, and go up to $7 on orders over $100. You are notified when you have missed the payment and given a period of 2 to 7 business days before charging the fine.

It can be easy to fall into debt when it comes to BNPL services, even without the interest we associate with a credit card. It is easy to become too comfortable financing your spending - so that coupled with constant missed payments, can snowball you into debt.

Klarna vs. competitors

One of the biggest advantages to Klarna, unique to them, is the ability to use it even if the retailer doesn't offer a BNPL option.

Whether you're scrolling through a website or walking around a market, you can use their flexible credit service.

As always it is best to research which company is best for your spending habits before using them - each has its own perks and disadvantages.

Pros and Cons

Pros

- Even if the retailer doesn't offer it as a payment option at the checkout, you can still shop anywhere using their digital card.

- No-interest finance options

- Quick and easy to use with the website, or using the app when you're on the move.

Cons

- You cannot build credit using them - Klarna doesn't report back on punctual repayment like with a credit card, so there is no positive impact on credit scores.

- You have no option to pay an instalment earlier, even if you have the money available for it.

Alternatives

Compare Australia's BNPL services on our buy now pay later services comparison page.

Popular choices include Afterpay, Zip and Humm - there is no shortage of different plans available!

FAQs

What does it cost retailers to accept Klarna?

Online retailers are bowing to consumer demand for flexible payments for their purchases. This means that more companies are partnering with Klarna to integrate their service into the checkout process.

They levy a fee from the retailers when consumers checkout with Klarna. This depends on the retailers' individual agreement but most commercial contracts mean that they take 5.99% per transaction.

Is there a Klarna app?

Klarna has a simple app that allows you to pay in-store and online, even if the retailer doesn't offer it as a checkout option. The app also gives access to exclusive product deals whilst you shop.

If you prefer, you can just access their services via the desktop and mobile website, to organise all your payments.

Does Klarna affect credit score?

If you keep up with all payments and are punctual with them, your score shouldn't be impacted at all.

The only downside to this is that paying everything on time and being responsible isn't reported, so doesn't boost your credit score like credit cards would.

Whilst it doesn't influence your credit score directly, there is a chance that other lenders may see the check on your credit report and use it when considering your eligibility for their services.

Also, if you consistently don't pay off your balance, Klarna may turn your debt over to a collection agency. This would show up on your credit file and impact your credit score.

With Klarna can you buy now pay later?

Yes, they have a variety of BNPL services, in the form of different payment plans:

- Buy now, repay in four interest-free instalments every two weeks

- Buy now, delay payment for 30 days.

- Finance bigger purchases with monthly payments over a period of 6-36 months. This requires a hard credit check and will involve interest if paying back over time.

Is Klarna better than Afterpay?

It depends on what you're looking for...

You may want to use Klarna for retailers that don't advertise a Buy Now Pay Later option, so you can always have the choice to finance your purchase. Also, the instalment and delayed payment plan mean you can keep shopping interest free, with no stress of hidden costs.

Afterpay works better for frequent shoppers who like to make smaller purchases as the application is effortless.

Verdict

Klarna is a line of credit and, as such, there are risks and penalties users should keep in mind.

Like its competitors, Klarna offers the flexibility to get what you want and pay over time.

However, it can be easy to fall into debt when it comes to BNPL services, even without the interest we associate with a credit card. It is easy to become too comfortable financing your spending - so that coupled with constant missed payments, can snowball you into debt.