Net worth is a simple metric of how much cash and assets a person has left once all their debts have been deducted. It’s a helpful way of getting a read on a person’s overall financial standing.

It should go without saying that “net worth” merely refers to your financial position as a snapshot in time, not your worth or value as a person.

Coming up next

What is included in your net worth?

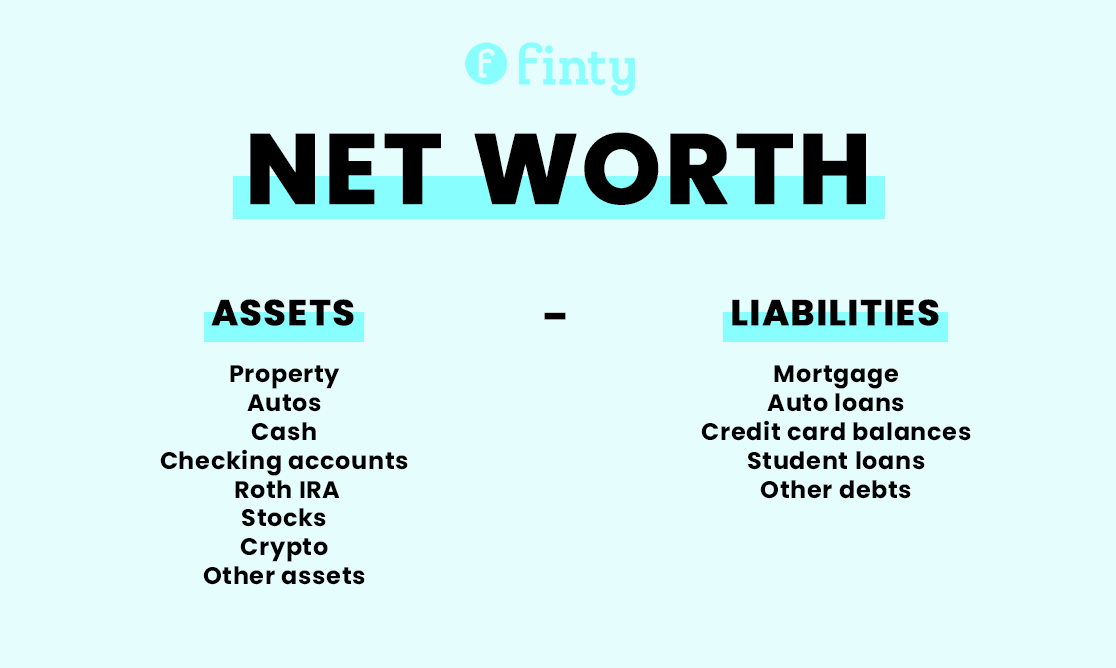

You’ll need to have two sets of numbers for your net worth. Your Assets and your Liabilities (aka debts).

Assets

An asset is something you own that has a financial benefit now or in the future. Examples of assets you may own include the following.

- Real estate. The most common example is your own home. Note that its value now may be higher or lower than when you purchased it.

- Land. For example, land you have inherited or purchased.

- Intellectual property. This could be anything from software, inventions, brand names and logos, etc.

- Precious metals. Gold and silver are the most commonly held precious metals, but can include other metals including platinum and palladium.

- Stock. Note that you should use the current value of any shares you have bought and are holding, not what you paid for them.

- Crypto. As is the case, your crypto holdings should be valued on their current market price. Don't forget to factor in returns from staked crypto.

- Alternative investments. Classic cars, artwork, vintage wine, farmland, collectibles (like trading cards and rare sneakers), etc.

- Cash in the bank. Most obviously, cash at hand is an asset, albeit one that isn't working for you.

Liabilities

A liability is something you owe. Examples of liabilities include the following.

- Mortgage.

- Auto loan.

- Credit card balances.

- Student loans.

How to calculate your net worth

People sometimes confuse their income with net worth. But it’s not just income, net worth is all the “things” you own aka your assets (either outright or bought using a loan) minus any debts you owe.

When calculating your personal net worth you can be as relaxed or in-depth as you want. If it’s just for your own curiosity then don’t sweat counting every last cent.

Follow this simple equation:

Net Worth = (Assets - Liabilities)

Net worth equation is Assets - Liabilities

Net worth example

Let’s say you have the following assets:

- Property: $400,000

- Cash in the bank: $10,000

- Car: $30,000

- Share portfolio: $20,000

- Crypto: $10,000

- Roth IRA: $50,000

Total Assets: $520,000

Liabilities:

- Mortgage: $300,000

- Auto loan: $20,000

- Credit card balances: $15,000

- Student loans: $25,000

Total Liabilities: $360,000

Net Worth = (assets - liabilities)

($520,000 - 360,000) = $160,000

Famous net worth examples

It can be fun to know the net worth of big names from the business world, Hollywood celebrities, sports stars and politics. Get ready for some big surprises.

Assets, Cash and Debts

To help you understand what net worth looks like here’s a few scenarios.

- #1 Great: Loads of Assets, good cashflow, low debt. Most people aim to end up having their house and autos fully paid off, enough income to live comfortably, and no bad debts.

- #2 Okay: Some Assets, okay cashflow, some debt. Other people could have a nice house, and a large mortgage (a good debt) but not much cash flowing into their bank account. They’d be asset rich, cash poor, and lots of debt.

- #3 Scary: Low Assets, low cashflow, high debt. The third scenario is not good. You won't want to stay in that situation for long. Get your income up, reign in your consumer debts, and then start building wealth.

10 tips for building your net worth

1. Improve your main source of income. This doesn’t have to be as drastic as changing careers. You could do this by clocking up more hours at work, doing overtime, or getting a promotion. Why is this important? Because your income is the single biggest driver of your net worth. You can leverage up against your income to buy more valuable assets that would otherwise take forever to save up to buy. Plus you can use the extra money to pay off debts sooner.

2. Add another income stream. Make money on the side, either online or in the offline world. One of our favorite ways to start a new stream of passive income is from crypto. Buy a stablecoin in crypto and lend it out to earn 10%+ APY. Or if you prefer stocks then buy and hold a dividend stock to earn 2-6% APY.

Don’t know what to do next?

90+ Money Making Ideas 🤑

Get Finty’s free guide of 90+ money making ideas online and offline, at home and beyond, for teens, for moms, for men, for anyone.

3. Add more assets that hold value or, better still, assets that appreciate (👆) over time. The point being, instead of buying an expensive auto – which depreciates in value over time – why not buy a cheaper sensible car and put the rest into something that goes up in value. Your home or a rental property which will go up in value long term plus you get to collect rent from tenants - which is also especially good because it is tax effective. Or buy stocks in growing companies such as Alphabet (Google), Apple, Amazon or Tesla. If picking stocks seems like too much effort then consider investing in a S&P 500 ETF. Or if you have the nerve to handle the volatility of crypto consider investing in Bitcoin, Ethereum, Cardano, Solana, Ripple XRP or a host of other altcoins.

4. Increase the value of your most important assets. If you own a home then make some improvements to boost its market value to buyers when you go to sell it.

5. Reduce your cost of living. Yes, that means being more frugal, cutting out frivolous spending or excessive purchases. In reality, the cost of food, drink and dining are the biggest areas where you can make the biggest and fastest improvements.

6. Wipe out debts. Not all debts are bad but since net worth is assets minus liabilities, if you can pay off credit card debt, personal loans, auto loans, and student loans, it'll boost your wealth. Plus the sooner you pay them off the sooner you can divert those payments to property, stocks or crypto.

7. Protect your important assets. Your house and car should be insured. If you hold crypto, make sure you keep wallet secure or hold your crypto with a trusted crypto exchange (don’t lose your password).

8. Invest in your education rather than entertainment. If you can continue to learn new skills or improve your existing skills then you'll greatly increase the likelihood of boosting income, or making better investments. This could be as simple as doing a course, reading books, listening to smart podcasts or learning from a mentor.

9. Build wealth building habits. Improve other things in your personal life that will make a positive difference to your net worth. For example, work out, eat well to stay healthy, get into a productive daily routine of rising early.

10. Put more of your wage into your retirement plans. A Roth IRA is a tax effective way to boost your net worth in the end.

Daily Routines

How do successful people structure their day?

Learn from the daily routines of highly effective people.